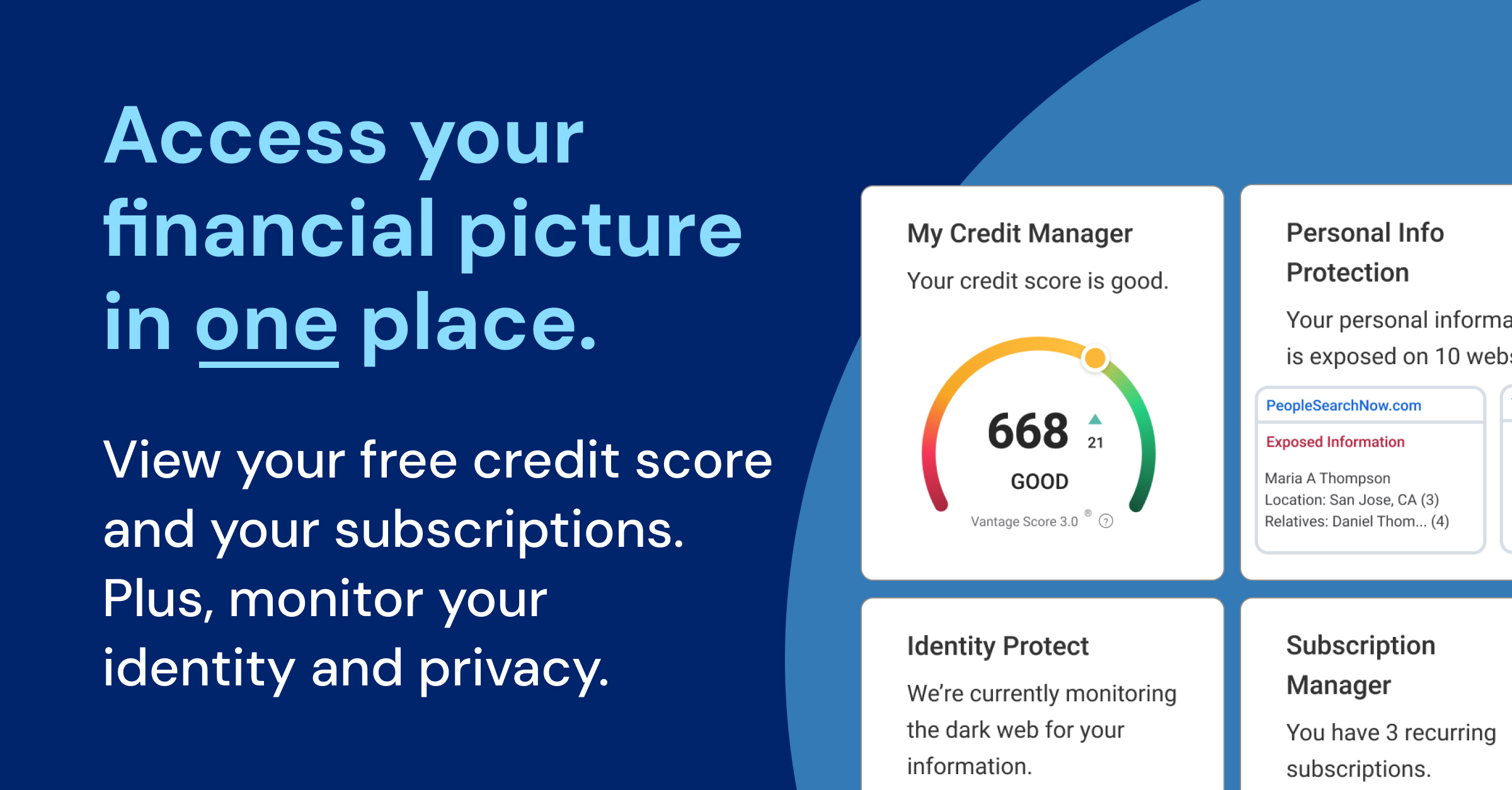

With Washington State Bank’s Online Banking and Mobile Banking, now you can! At no cost to you, you can access these features today in the Financial Health Widget:

-

Your credit score: Check out your VantageScore® 3.01

-

Dark web monitoring:2 We scan the web for fraudulent use of your personal information including name, address, email and more

-

Personal information monitoring: We scan your name in real time to see how much of your private information has been exposed on Data Broker sites3

-

Online subscriptions view: Access a consolidated view of your subscriptions to see where your dollars are going

In addition to the free features within My Financial Health, you can upgrade to Premium to unlock:

- Credit monitoring and alerts from all 3 bureaus: Get alerts whenever there is a credit event such as a new account being opened or a hard credit inquiry. Additional alerts, such as balance changes, public records, address changes, delinquencies, and credit score changes are also available.

- Social Security Number monitoring: Detect and prevent identity theft occurring outside of the credit bureaus’ vision

- Change of address alerts: Detect and be alerted when there has been an unauthorized change of address

- Identity theft insurance: Up to $1M of identity restoration and protection against identity theft4

- Identity restoration: Access hands-on assistance restoring compromised identity

- Removal of personal information from Data Broker sites:5 Leverage automated services to continuously remove their personal data from these sites

- Ongoing web monitoring for newly exposed private information: Continuously monitor Data Broker sites and get alerts when your personal information resurfaces

- Online subscriptions cancellation: With just a single button, cancel unused or low value subscriptions

- Credit building: Build credit or establish credit history with credit building features7

- Student loan assistance: View your total federal student loan balance, identify the plan with the most savings and enroll, and monitor details with timely recertification.

All for $8.99/month.6 Log in to upgrade today!

2 Dark Web monitoring consists of searching for up to 1 Social Security number, 10 driver's licenses, up to 10 credit and debit cards, up to 10 bank accounts, 10 passports, up to 10 phone numbers, up to 10 email addresses, up to 10 physical addresses, and 10 medical IDs. We partner with Constella Intelligence who searches thousands of internet sites where it is suspected that consumer's personal information is being bought and sold. Constella Intelligence regularly reviews and adds new sites to search; however, there is no guarantee that Constella Intelligence will be able to locate and search every possible internet site as some sites are not published and frequently change. Dark Web monitoring may take several days to begin and may not occur during your access period.

3 Please note that the list of Data Broker sites being scanned may change as we do not crawl all Data Broker sites.

4 Terms and conditions apply. The Identity Theft Insurance is underwritten and administered by AIG. This description is a summary and is solely intended for informational purposes and may not include all terms, conditions and exclusions of the policies described. Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in all jurisdictions. Review the Summary of Benefits.

5 Data Broker sites are sites that trade personal information for profit - names, addresses, phone numbers, social security numbers and more. As a result, consumers are at risk of identity theft, financial hacks, account takeovers, spam, robocalls, and physical threats including stalking, harassment and doxing. Please note that the list of Data Broker sites being scanned may change as we do not crawl all Data Broker sites.

6 Plus applicable taxes. $8.99 (plus applicable tax) will be debited from your account when you enroll, and then monthly until you cancel.

Advertisers Disclosure: Credit Builder loan and deposit account are both provided by Cross River Bank, Member FDIC, an Equal Housing Lender. Credit Builder loan and deposit account(s) are serviced by BuildCredit LLC. We may receive a payment if you apply for and receive one of our partner’s products. This may influence which products we review and write about (and where those products appear on the app), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research.