Tips to Boost Financial Confidence During Credit Education Month – Mar. ‘26

In recognition of Credit Education Month Washington State Bank and the Independent Community Bankers of America® (ICBA) are encouraging consumers to strengthen their financial well-being by building healthy credit habits and establishing long-term savings strategies.

To support consumers during Credit Education Month, WSB and the ICBA encourage individuals to consider the following steps:

- Pay yourself first. Automate savings contributions to build consistency and momentum. Set these up easily within your WSB Online Banking or Mobile Banking app under the ‘Transfer’ tab.

- Track spending and plan ahead. Create a budget to find opportunities to save and avoid debt.

- Build an emergency fund. Aim to set aside three to six months to cover essential expenses. Opening a specific savings account for your emergency fund can help keep things organized and still readily available. Set up an automatic transfer to the account and watch it grow each month!

- Use credit responsibly. Make payments on time, keep balances manageable, and avoid opening or closing accounts unnecessarily.

- Monitor credit regularly. Review credit reports to spot errors, detect fraud early, and understand how financial behaviors impact credit standing. Take advantage of the My Financial Health widget inside your WSB Online Banking and Mobile Banking app. Here you can find your credit score, monitor subscriptions, and screen your identity online.

“Strong credit and smart saving go hand in hand,” ICBA President and CEO Rebeca Romero Rainey said. “Understanding how to manage credit, build savings, and plan ahead is essential to long-term financial security. “Community banks are uniquely positioned to provide personalized guidance and trusted financial solutions that help individuals build resilience, plan for the future, and achieve lasting financial success.”

To learn more about improving your financial health or to speak with a local banker, stop by a nearby branch during Credit Education Month.

About ICBA

The Independent Community Bankers of America® has one mission: to create and promote an environment where community banks flourish. We power the potential of the nation’s community banks through effective advocacy, education, and innovation.

As local and trusted sources of credit, America’s community banks leverage their relationship-based business model and innovative offerings to channel deposits into the neighborhoods they serve, creating jobs, fostering economic prosperity, and fueling their customers’ financial goals and dreams. For more information, visit ICBA’s website at icba.org.

Top Five Fraud Trends to Be Aware Of – Feb. ‘26

National Safer Internet Day is Feb. 10, and WSB is encouraging customers to strengthen online habits and stay alert to the rising number of digital scams. Fraud activity continues to climb nationwide. According to the Federal Trade Commission (FTC), consumers reported more than $12.5 billion in losses in 2024 – a 25% increase from the prior year.

Investment scams had the highest monetary loss in 2024 with $5.7 billion in losses, followed by $2.9 billion lost to imposter scams. Consumers also lost more money through bank transfers and cryptocurrency than all other payment methods combined. These trends continue to rise, with scammers adopting more aggressive tactics, including artificial intelligence (AI)-generated impersonation, social media-based deception and more.

Here are the top five fraud categories reported in 2025, based on Federal Trade Commission data.

- Imposter scams – 516,724 reports

Imposter scams remain the most reported fraud type in the country. Scammers continue posing as banks, government agencies, family members or well-known companies; now using AI-generated voices, spoofed phone numbers or convincing emails. These scams pressure people to act quickly, send money or share account information. Customers should verify any unexpected request by contacting the organization or person directly using a verified phone number.

- Online shopping and negative reviews – 193,020 reports

Online shopping scams continue to grow, driven by fraudulent ads on Facebook, Instagram, TikTok and other platforms. In August 2025, the FTC warned consumers about “big discount” social media ads impersonating real brands, which often link to fake websites designed to steal money or personal information. Shoppers may receive a counterfeit product or nothing at all.

To stay safe, research the seller, compare prices and use a credit card for purchases. Scammers often push customers toward gift cards, wire transfers, payment apps, or cryptocurrency – all red flags.

- Internet services – 118,071 reports

These scams include fake tech-support calls, phony antivirus subscriptions, and pop-up warnings claiming your device is compromised. Scammers often request remote access or immediate payment. Avoid clicking on pop-ups and contact service providers using verified customer service numbers.

- Business and job opportunities – 75,364 reports

Scammers continue targeting people searching for jobs or supplemental income. Fake job postings, business “starter kits,” and work-from-home offers often require upfront payment or ask applicants to transfer money during the “hiring process.” Legitimate employers never ask new hires to pay fees or move funds for them.

- Investment-related scams – 66,703 reports

Investment scams remain one of the most expensive fraud categories. High-pressure cryptocurrency schemes, fake trading platforms and AI-driven “advisors” continue to promise guaranteed returns. If an investment sounds too good to be true, it likely is. Independent verification is critical.

These tips are provided by the Iowa Bankers Association.

Common Types of Identity Theft – Jan. ‘26

In observance of Identity Theft Awareness Week, Washington State Bank encourages consumers to be aware of the many different types of identity theft and how to avoid it. The Federal Trade Commission received more than 1 million reports of identity theft in 2024, with credit card abuse being the main method of identity theft.

Washington State Bank encourages you to stay aware of common types of identity theft and how to avoid it:

Account takeover fraud – In this type of fraud, scammers use stolen information like usernames, passwords and account numbers to take over social media and bank accounts. Then, they reset passwords or emails to lock the user out of their own accounts.

- Action step – Enable multifactor authentication (MFA) and consider using a password manager. MFA adds an extra security step to prevent unauthorized access even if your password is stolen. Password managers create strong, difficult-to-guess passwords to keep criminals at bay.

Debit and credit card fraud – Fraudsters use stolen account information to withdraw funds or make purchases with your card.

- Action step – Put a freeze on cards the minute they’ve been lost or misplaced and quickly request a new card if the card does not turn up soon. Additionally, regularly monitor accounts for suspicious transactions and report them immediately.

Tax fraud – With tax season in full swing, it’s important to avoid fraudsters posing as the IRS. This occurs when criminals use your Social Security number to file a tax return to steal your refund.

- Action step – Be aware the IRS will always make its first official contact via mail. Do not answer or respond to any supposed calls or texts from the IRS if you haven’t first received a letter.

Learn More

For more information on common identity theft tactics, visit the Federal Trade Commissions website: https://consumer.ftc.gov/identity-theft-and-online-security/identity-theft.

These tips are provided by the Iowa Bankers Association.

Recap Your Financial Year and Plan for the Next- Dec. ‘25

With the end of 2025 drawing near, it’s a great time to look back at spending patterns and habits, review savings and investments, make a plan for paying off debt, and set financial goals for the upcoming year. By taking a few simple steps at the end of the year, you can enter 2026 feeling organized and confident about meeting your financial goals. Washington State Bank has steps you can take to achieve your financial goals.

Review accounts — Before setting new goals, take the time to closely review financial information like bank and investment accounts, credit card bills, loan balances and any outstanding debt. Be sure your spending aligns with your goals.

Analyze spending habits — Identify areas where you spent more than you planned to, like non-essentials, eating out or unused subscriptions. Whatever it is, make a budget for it and stay within that budget — small adjustments can make a major impact in the new year.

Evaluate savings and investments — Assess whether you’re staying on track with savings and investment goals. Increase contributions to IRAs or 401(k) accounts if possible and consider rebalancing your investment portfolio.

Get ready for tax season — Stay organized by gathering documents like paystubs, donation and deductible expense receipts ahead of tax season.

Establish goals for the upcoming year — After taking the time to reflect and assess, use these insights to set realistic and timely goals. Consider using a budget-tracking app or mastering an Excel spreadsheet. Decide what milestones you’re striving toward — retirement, buying a house, or saving for college.Don’t Let Scammers Steal Your Joy This Season – Nov. ‘25

International Fraud Awareness Week is coming up (November 16th-22nd), and Washington State Bank is urging consumers to use extra caution online this holiday season. Scammers take advantage of unique opportunities during the holiday season to defraud consumers. These involve phishing emails, charity scams, delivery scams and travel scams. The busyness of the season makes scams easier to miss, and in 2024, nearly 60% of the U.S. population made a purchase during Cyber Week (Thanksgiving through Cyber Monday).

During the season of giving, make sure scammers don’t steal your sensitive information and money by learning about these common types of scams during the holiday season:

- Phishing scams – Online shopping makes it easy to complete the gifting checklist, but also presents more opportunities for fake deals, counterfeit websites, and prices that are a “little too-good-to-be-true.” Be wary of clicking on links from social media ads or buying from websites without “https” in the URL.

- Charity scams – Fraudsters want to capitalize on people’s generosity during the holiday season by creating fake charities and organizations. Counterfeit charities may play on people’s emotions, pressure them to donate, ask for forms of payment like crypto or gift cards, and are vague about where exactly the money is going. Research the legitimacy of charities on websites like BBB Wise Giving Alliance and Charity Navigator before donating.

- Delivery scams – Online shopping means the anticipation of package deliveries and receiving delivery status updates. Scammers may send phony emails with fake delivery updates, pretending to be FedEx, Amazon, and UPS and attempt to get you to share personal information. Keep in mind – these companies won’t send unsolicited messages asking for personal or payment information.

- Travel scams – Fake travel agencies may advertise discounts on airfare, luring people who travel during the holiday season. These scams are especially malicious because of sensitive information needed for legitimate travel like your address and credit or debit information. Double check URLs and be wary if your login information isn’t working on travel websites.

Tips in Honor of World Financial Planning Day – Oct. ‘25

Financial planning is something every age group can participate in, and in honor of World Financial Planning Day on October 8th, Washington State Bank is encouraging people of all ages to set aside time to evaluate financial goals.

According to Motley Fool Money, the average American scores just 48% on financial literacy tests. From childhood to retirement, financial planning and literacy is about more than just numbers — it’s about achieving milestones, aligning money with your goals, and providing peace of mind. Take steps to improve financial literacy and planning. There are unique focuses for each age group when it comes to financial planning. Here’s a few recommendations for every phase of life.

Teens and younger – It’s important to teach financial literacy to younger people. Start with a simple budget, like the 50/30/20 rule for needs, wants and savings. Instilling confidence at a young age sets kids up to handle bigger responsibilities down the road.

In your 20s – You can build a lifetime’s worth of wealth by building a strong foundation in your 20s. Start investing for retirement, start an emergency fund, and work to establish healthy habits by distinguishing between needs and wants. It’s also a great time to chip away at high-interest debt from higher education, credit card, or car loans.

In your 30s and 40s – Strive to increase retirement contributions as income levels grow. Continue to save for major goals, like buying a house, growing your family, or paying for a child’s education.

In your 50s and 60s – As retirement nears, shift priorities toward protecting wealth and preparing for life post-workforce. Plan withdrawal strategies, pay off any remaining debt, and continue strong investment strategy.

These tips are provided by the Iowa Bankers Association.

7 Strategies for Spotting Counterfeit Money

The process of producing counterfeit currency continues to grow more sophisticated, especially with recent advancements in technology. But there are still plenty of telltale signs that can help you and your employees distinguish counterfeit money vs. real money. Do you know how to detect counterfeit bills? Here’s what to look for when you receive cash from customers.

- Check the Feel of the Paper

The texture of real currency is distinct because of the special paper it is printed on. When you’re holding an authentic banknote, feel the bill and note the difference in texture compared to fake money.

- Examine Borders and Printing

Another tip is to inspect the borders and edges of bills. Counterfeit money often has uneven or blurry printing. A counterfeit U.S. bill may even appear crooked. On the other hand, legitimate currency will have crisp, well-defined edges.

Theatrical currency can appear to be legitimate to the naked eye. Look closely for verbiage like, “For Motion Picture Purposes” or “COPY” printed along the bill as well as misspelled words.

- Look For Red and Blue Threads

Real U.S. bills have embedded red and blue threads in the paper. You’ll know a bill’s fake when it has printed or missing threads instead. Thus, looking for the proper-colored threads is a quick authenticity check to distinguish fake money vs. real money.

- Inspect Serial Numbers

When learning how to check for counterfeit money, you should also pay attention to the serial numbers shown on bills. The serial numbers on a single bill should be the same. So, if you notice a bill has mismatched serial numbers, it’s another good indication that it’s counterfeit.

- Check For Security Threads

When you’re learning how to spot fake money, looking for the security thread – and ensuring it’s in the proper location – is highly important. You should only see it when you hold the bill up to the light. If it’s on the wrong side of the face for the denomination, it’s likely fake. Since 2009, $100 bills have featured a blue security ribbon woven into the paper — not printed on it. Make sure to look for this feature when accepting a $100 bill, tilting the banknote to ensure the holographic images shift in the blue ribbon.

- Look For Ink Bleeding or Smudging

Inspect all bills for ink inconsistencies that may indicate it’s fake, such as bleeding or smudging. These are signs of poor printing quality, as real currency does not have ink that will react in this manner.

How to Protect Your Business from Counterfeit Money

Cash handling procedures for restaurants, retailers, and other types of cash-heavy businesses should consider including the above authenticity checks. Taking proactive steps like proper staff training can help safeguard your business from counterfeit bills.

Click here for a visual of signs to look for.

These helpful hints to aid in detection of counterfeit currency do not guarantee the genuineness of any banknote.

This article is a summary of the following: https://integratedcashlogistics.com/how-to-spot-counterfeit-money/

5 Ways to Teach Kids About Money – Aug. ‘25

The start of a new school year offers more than a fresh supply list – it’s also a good time for families to revisit financial habits at home. With rising costs impacting everything from classroom supplies to after-school activities, helping kids understand how money works can set them up for a stronger financial future.

1. Start with a regular allowance – Whether it’s tied to chores or not, allowing kids to “earn” a consistent allowance can be a great way to teach responsibility. Work with them to create a simple plan for how they’ll use their funds, such as dividing it into spending, saving, and giving using the three-jar method.

2. Set a savings goal – Encourage your child to save for something meaningful, such as a special toy or upcoming event. Help them break the goal into weekly amounts to show them how savings add up over time.

3. Talk through “needs vs. wants” – Back-to-school shopping is a great time to discuss the difference between needs and wants. Let your child help make purchase decisions based on a set budget.

4. Track spending with a basic tool – Whether it’s a notebook, spreadsheet or app, kids benefit from tracking where their money goes. Parents and kids should monitor transactions and savings growth together.

5. Match their savings – To encourage consistent saving, consider offering a match. For example, adding $1 for every $5 they save. This not only builds motivation but reinforces the long-term value of saving.

By teaching basic money habits early, families can help kids build confidence and make smarter financial decisions as they grow.

Learn More

To learn more about a WSB Student Checking Account, click here. To learn more about a WSB Student Savings Account, click here. Washington State Bank, Member FDIC.

FDIC-Insured - Backed by the full faith and credit of the U.S. Government

These tips are provided by the Iowa Bankers Association.

Travel Tips for a Worry-Free Vacation- July ‘25

As summer travel heats up, Washington State Bank and the Independent Community Bankers of America (ICBA) share key tips to help travelers protect their finances and enjoy peace of mind on the go. From budgeting for the unexpected to securing your financial information, a little preparation can go a long way in making travel experiences safe and stress-free.

8 Financial Travel Tips from ICBA and Washington State Bank:

- Notify your community bank of your travel plans to avoid account holds or declined transactions when unusual transactions are presented for processing.

- Carry a chip-enabled card, particularly if your travel plans take you overseas where chip technology may be a prerequisite for card acceptance.

- Bring backup payment methods in case one is misplaced or restricted. Families or couples can carry different cards for added security.

- Create transaction alerts for credit and debit cards so you can respond quickly to unusual activity. If you suspect fraud, contact your bank and credit card providers immediately.

- Check card readers for signs of tampering. When in doubt, choose another terminal.

- Lock away valuables such as passports, backup credit cards, financial information, and cash.

- Use social media with care. Posting your pictures or whereabouts during travel could leave you susceptible to security risks back home.

- Monitor account activity. Regularly check for unauthorized transactions and when you return home, review your statements. Save your receipts to compare with your charges.

Planning for financial security during travel is just as important as packing your bags. Contact Washington State Bank for guidance on preparing your finances and travel safeguards before setting out this summer.

About ICBA

The Independent Community Bankers of America® has one mission: to create and promote an environment where community banks flourish. We power the potential of the nation’s community banks through effective advocacy, education, and innovation.

As local and trusted sources of credit, America’s community banks leverage their relationship-based business model and innovative offerings to channel deposits into the neighborhoods they serve, creating jobs, fostering economic prosperity, and fueling their customers’ financial goals and dreams. For more information, visit ICBA’s website at icba.org.

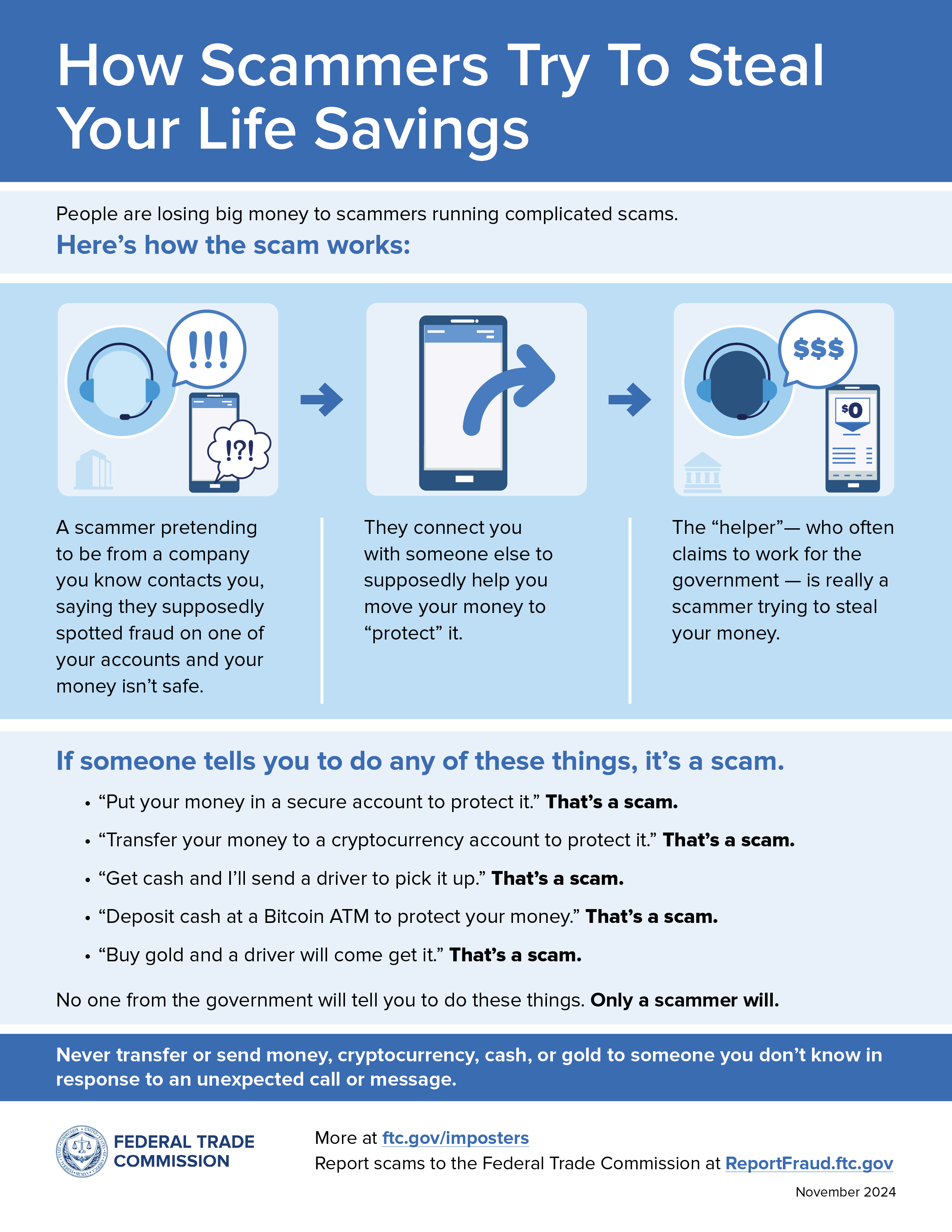

How Scammers Try to Steal Your Life Savings - June '25

Tips to Save for Homeownership – May ‘25

Buying a home can be stressful regardless of the stage of life you’re in. When you start planning to buy a house, it can be intimidating to think about how much money you must save. However, once you start down the path, it may seem easier than you originally thought.

Set a goal

When you begin to consider buying a home, it’s important to determine an affordable price range for your house hunt. Homebuying costs, such as the down payment and closing costs, are often expressed as a percentage of the home price. With a purchase price in mind, you can set a specific savings goal.

Start by ensuring you’re financially ready to make such a large purchase. Factors to consider include your total savings, total debt, and credit history. These factors will help determine your qualifying loan amount, interest rate, and how much you can afford as a down payment.

When it comes to down payments, the more you can pay up front, the lower your payments and the higher your equity. Savvy homebuyers put down 20%. This isn’t a requirement, but doing so could help reduce the interest rate on your mortgage and help you avoid costly private mortgage insurance. In addition, consider closing costs and moving expenses when thinking about your savings goal. Between moving expenses, home furnishings, and any potential mishaps that may arise, it is important to plan to have extra cash on hand to cover these expenses.

Find your savings goal by adding up rough estimates for each expense — down payment, closing costs and other cash to have on hand.

Tighten your budget and save any extra cash

To attain that goal, create a plan. Start by minimizing other expenses. Compare car or health insurance rates to find the best deal. You might also be able to save by researching and finding lower-cost options for services you need such as your internet or cell phone plan. In addition, make sure you cancel subscriptions you’re not using.

When extra money comes your way, save instead of spending. Whether it is from a gift or extra income, be sure to put it into savings.

Keep your savings in a separate account

When you’re saving to buy a house, you want your money to work harder for you by depositing it in an interest-bearing account. Use an account's annual percentage yield (APY) to compare options. A higher APY means your money grows faster. Typically, the best options are high-yield savings accounts, money market accounts, or certificates of deposit. Talk to one of our Personal Bankers to discuss what the best option is for you.

Saving to buy a home may feel like an uphill climb. However, small actions add up and make a difference. Washington State Bank is here to help you reach your goal of purchasing your dream home.

Empowering Financial Futures: Highlighting the Importance of Financial Literacy - Apr. '25

Washington State Bank and the Independent Community Bankers of America (ICBA) are celebrating Financial Literacy Month in April by encouraging Americans to take control of their financial future and learn fiscally responsible habits that can benefit them at every age and stage of their financial journey. Twenty-seven percent of Americans report that “just getting by financially or finding it hard to get by” describes them completely or very well. Meanwhile 59% want financial advice, but only a third (32 percent) turn to registered financial advisors for help, despite the fact that 68 percent indicated a

Often referred to as America’s favorite lenders, community banks are financial experts with a wealth of knowledge and local expertise to help consumers with:

- Budgeting to help you track income and expenses and build a plan to manage your finances, reach your financial goals, and create a nest egg.

- Saving and investing to help you assess savings and investment goals and vehicles.

- Using credit to establish and maintain good credit so you can reap the benefits from this convenient and flexible form of payment without the consequences of mismanagement.

- Understanding debt load and available options like debt consolidation before taking out a loan.

“Understanding key financial principles, like budgeting and managing credit wisely, is essential for achieving long-term financial security," ICBA President and CEO Rebeca Romero Rainey said. "Community banks like Washington State Bank are trusted advisors, offering the local expertise and personal connections that help individuals achieve financial independence."

ICBA also offers financial literacy programs through community bank partners including Visa’s Practical Money Skills, the FDIC’s Money Smart initiatives. To find one of our community bank locations in your area visit, banklocally.org.

About ICBA

The Independent Community Bankers of America® has one mission: to create and promote an environment where community banks flourish. We power the potential of the nation’s community banks through effective advocacy, education, and innovation.

As local and trusted sources of credit, America’s community banks leverage their relationship-based business model and innovative offerings to channel deposits into the neighborhoods they serve, creating jobs, fostering economic prosperity, and fueling their customers’ financial goals and dreams. For more information, visit ICBA’s website at icba.org.